Top methods to find a reliable Medicare advisor near you

Learn How a Medicare Agent Can Offer Guidance for Your Health Demands

Maneuvering via the intricacies of Medicare can be daunting for lots of individuals. Understanding the various components and alternatives available is crucial for making educated decisions regarding health coverage. A Medicare agent can play a vital function in this process. They use insights customized to specific demands. Picking the appropriate agent is simply as substantial as recognizing the plans themselves. What variables should one think about when seeking advice in this essential location?

Understanding Medicare: The Fundamentals

Additionally, individuals may select to enroll in Medicare Advantage Program, which supply an alternative method to obtain Medicare advantages via personal insurance provider. Part D supplies prescription medication protection, permitting recipients to acquire essential medications at decreased prices. Understanding these components is crucial for maneuvering the system effectively, making certain that people get the suitable protection customized to their wellness requirements while taking care of costs successfully.

The Role of a Medicare Agent

Many individuals maneuvering the intricacies of Medicare discover important aid through the knowledge of a Medicare agent. These specialists function as knowledgeable overviews, assisting customers recognize the different parts of Medicare, including Component A, Part B, Component C, and Part D. Their duty includes reviewing specific health demands, monetary conditions, and choices to recommend ideal strategies.

Medicare representatives remain upgraded on the most up to date plan modifications, making sure that customers obtain exact and timely information. They help in clearing up the registration procedure, due dates, and eligibility criteria, reducing the complication commonly linked with Medicare. In addition, agents simplify contrasts in between different plans, highlighting insurance coverage choices, costs, and prospective out-of-pocket expenditures.

Through customized consultations, Medicare representatives encourage customers to make enlightened decisions concerning their healthcare insurance coverage. Eventually, their proficiency not just minimizes anxiety however likewise improves the total experience of passing through Medicare alternatives.

Benefits of Working With a Medicare Agent

Functioning with a Medicare agent uses considerable advantages for people handling their health care alternatives. These experts supply customized protection recommendations tailored to specific demands, making certain clients make educated choices. In addition, their expert assistance and ongoing support can streamline the frequently complex Medicare process.

Personalized Insurance Coverage Options

Maneuvering the intricacies of Medicare can be frustrating for beneficiaries, specifically when it pertains to selecting the best coverage alternatives customized to specific needs. A Medicare agent plays a crucial role in simplifying this procedure by reviewing each recipient's special health demands, monetary situation, and preferences. They can supply a variety of plans, including Medicare Advantage, Supplement plans, and Part D prescription medicine protection. By utilizing their knowledge, beneficiaries can identify choices that not just satisfy their health care requires but also fit within their spending plan. This personalized strategy warranties that individuals receive the most ideal coverage, maximizing their benefits while lessening out-of-pocket costs. Ultimately, working with a Medicare agent boosts the total experience of picking Medicare protection.

Expert Advice and Assistance

Maneuvering with Medicare options can be intimidating, however the advice of a Medicare agent substantially minimizes this concern. These experts possess in-depth knowledge of the different plans offered, consisting of Medicare Advantage and Medigap plans. They give individualized assistance, aiding individuals recognize their unique health and wellness requirements and financial situations. Agents additionally remain upgraded on altering advantages and guidelines, making certain clients receive the most current information. By assessing different strategies, a Medicare agent can assist in identifying the very best protection alternatives, which can cause substantial cost savings. Furthermore, their proficiency extends past registration, using recurring support to browse claims and address any type of problems that might develop. Medicare advisor. This collaboration empowers beneficiaries to make informed choices about their health care

Personalized Plan Contrasts

Customized Protection Options

Exactly how can people find one of the most ideal Medicare protection for their one-of-a-kind needs? Customized protection options are vital in ensuring that each private obtains the most suitable medical care plan. Medicare agents play a vital duty in this process by analyzing personal health conditions, drugs, and favored doctor. They provide tailored strategy comparisons that highlight the distinctions amongst readily available protection choices, consisting of Medicare Benefit and Component D strategies. This personalized approach permits clients to comprehend the advantages and constraints of each plan, guaranteeing educated decision-making. By concentrating on one-of-a-kind requirements, Medicare representatives assist people browse the intricacies of Medicare, eventually resulting in even more efficient and satisfying medical care solutions. Tailored insurance coverage choices encourage beneficiaries to choose strategies that straighten with their details conditions.

Price Analysis Techniques

Assessing the expenses connected with Medicare plans requires a strategic method that considers specific monetary scenarios and healthcare needs. A Medicare agent plays an important duty in this procedure by using individualized strategy contrasts. By analyzing premiums, deductibles, and out-of-pocket costs, agents assist clients identify strategies that align with their budget plan and health requirements. This personalized evaluation reaches reviewing prospective prescription medication costs and solution schedule within particular geographical locations. In addition, representatives can highlight financial aid options for those who might qualify, guaranteeing that clients make notified choices that optimize their health care costs. Eventually, these expense analysis methods equip clients to pick one of the most appropriate Medicare plan for their special conditions.

Strategy Perks Review

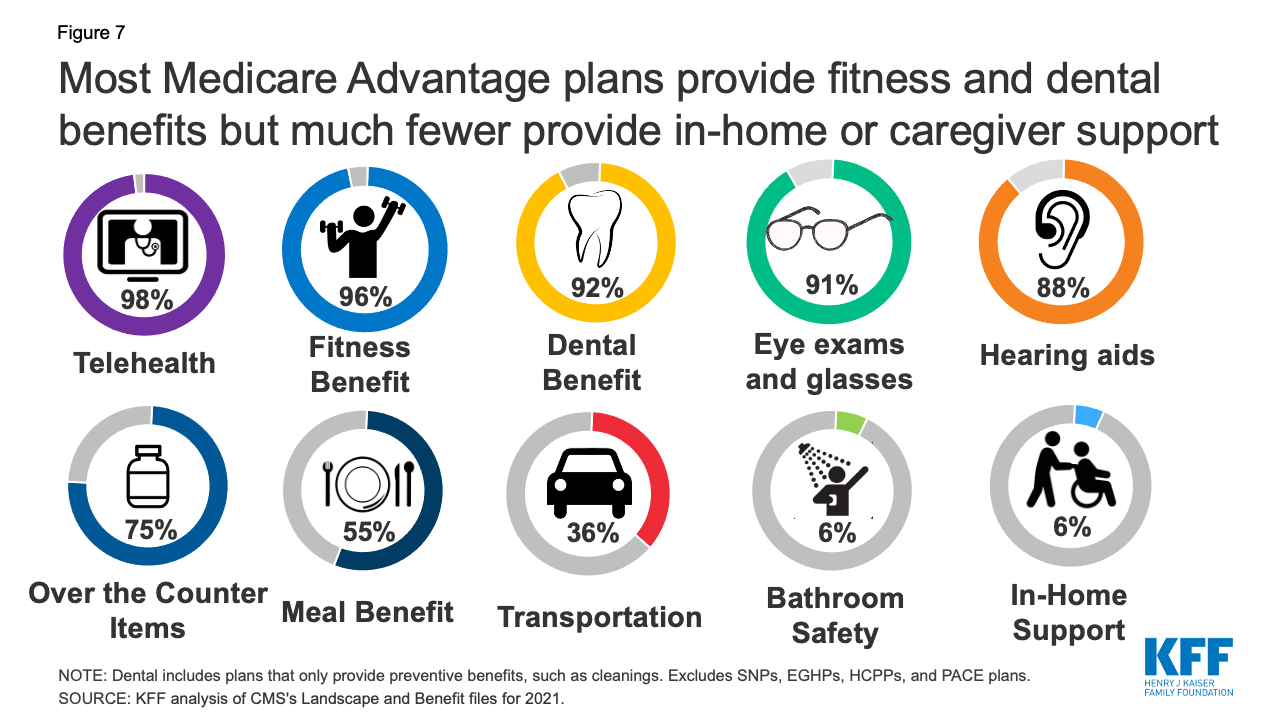

Recognizing the subtleties of Medicare plan advantages is vital for making informed medical care choices. A Medicare agent plays an important duty in giving individualized plan comparisons customized to specific health demands. By analyzing various alternatives, representatives can highlight particular advantages, such as insurance coverage for preventive solutions, prescription medicines, and specialized treatment. This tailored strategy allows beneficiaries to examine just how various plans align with their medical care demands and economic situations. In addition, representatives can discuss the details of additional advantages like vision and oral protection, which might not be included in every plan. Ultimately, leveraging a Medicare agent's knowledge aids people browse the intricacies of strategy advantages, guaranteeing they pick the most suitable option for their special situations.

Recurring Support and Assistance

Continuous support and aid play a necessary duty in the success of Medicare representatives as they browse the intricacies of the program. These experts are charged with staying upgraded on policy changes, plan choices, and regulations that affect their customers. Continual education and training guarantee agents have the most up to date knowledge to offer exact assistance.

Agents commonly develop long-term partnerships with their customers, supplying customized support customized to specific health and wellness needs and preferences. They help in comprehending advantages, submitting claims, and dealing with problems that may arise during the registration procedure.

Furthermore, representatives can serve as a vital resource for clients inquiring about supplementary coverage or prescription medication strategies. This ongoing partnership encourages customers to make informed choices and adapt to their changing health conditions, inevitably improving their total experience with Medicare. Such support cultivates count on and complete satisfaction, contributing significantly to the agent-client relationship.

Exactly how to Pick the Right Medicare Agent

How can one establish the best Medicare agent to fulfill their needs? Individuals need to look for representatives with appropriate accreditation and licenses, ensuring they are experienced regarding Medicare programs. It is suggested to examine their experience, especially in dealing with clients that have comparable health and wellness scenarios. Testimonials and testimonials from previous clients can give understanding into an agent's dependability and service quality.

Next off, possible clients ought to examine the agent's interaction design; clear and patient interaction is essential for comprehending complicated Medicare choices. It is also essential to inquire whether the agent stands for numerous insurance provider, as this expands the variety of readily available plans and permits customized referrals - Medicare supplement agent near me. People need to really feel comfy asking concerns and sharing problems, as an excellent agent will certainly prioritize their customers' requirements and give enlightened assistance throughout the registration procedure.

Regularly Asked Concerns

Exactly how Do I Know if I Need a Medicare Agent?

Figuring out the requirement for a Medicare agent involves reviewing one's understanding of Medicare alternatives, complexity of medical care demands, and convenience with maneuvering through the system independently. Medicare agent. Seeking specialist a fantastic read guidance can streamline decision-making and improve coverage selections

Are Medicare Professionals Free to Utilize for Customers?

Medicare representatives typically do not bill customers directly for their solutions - Medicare advantage agent near me. Instead, they are made up by insurance policy firms for enlisting customers in plans, making their assistance successfully cost-free for individuals looking for Medicare advice and alternatives

Can I Change My Medicare Strategy Anytime?

Individuals can change their Medicare strategy during particular enrollment periods, such as the Yearly Enrollment Period or Special Enrollment Durations. Outside these times, changes are usually not allowed, restricting adaptability in strategy changes.

What Qualifications Should I Look for in a Medicare Agent?

When choosing a Medicare agent, individuals ought to seek credentials such as appropriate licensing, substantial expertise of Medicare strategies, strong interaction abilities, and favorable consumer testimonials, guaranteeing they get trusted and personalized support in exploring their choices.

How Do Medicare Representatives Earn Money for Their Solutions?

Medicare agents usually make payments from insurance provider for each and every policy they sell - Medicare supplement agent near me. These compensations can differ based upon the type of plan and may consist of recurring repayments for revivals, incentivizing agents to supply ongoing support

Furthermore, individuals may select to enlist in Medicare Benefit Plans, which use an alternative means to get Medicare advantages with personal insurance firms. Lots of individuals maneuvering the intricacies of Medicare find useful assistance via the competence of a Medicare agent. Maneuvering via Medicare alternatives can be intimidating, yet the guidance of a Medicare agent substantially eases this worry. By focusing on distinct needs, Medicare agents assist people browse the complexities of Medicare, ultimately leading to more acceptable and reliable health care services. Identifying the demand for a Medicare agent includes evaluating one's understanding of Medicare alternatives, intricacy of healthcare requirements, and convenience with maneuvering via the system independently.